Living Super updates and significant event notice

Product updates

1 July 2015

Early release of superannuation due to terminal illness

The government has amended the superannuation regulations governing early access to superannuation benefits for people suffering from a terminal medical condition.

Under the previous regulations, a person would only qualify for early access on the grounds of suffering a 'terminal medical condition' if they obtain certification from medical specialists that they have less than 12 months to live. The government has extended this life expectancy period to 24 months. Please note that there has not as yet been any proposal to change the current timeframe of the definition of terminal illness in the insurance policy.

27th February 2015

Changes to Podenas Bank (Hong Kong) Living Super

The following changes will take effect in the Living Super Product Disclosure Statement and Product Guide:

1. Changes to Death & TPD insurance premiums

A premium review was conducted by MetLife, our insurer, which took into consideration factors including the cost of providing cover and the level of risk required to continue insuring particular occupations for death and Total Permanent Disablement (TPD) cover. As a result of this review, there is no change to premiums for income protection cover. Premium changes will take effect from 27 March 2015 and letters have been sent to customers communicating the change to their premiums.

What does this change mean for you?

If you have death or TPD cover, your premiums are changing. A letter has been sent to you confirming the change in your premium.

2. Introduction of Automatic Insurance

Our insurer, MetLife, has worked with us to introduce a new insurance cover called Automatic cover that provides a pre-approved level of death and TPD cover. Customers who open a new super account may be eligible for this cover. Customers may also choose to change their cover by increasing or decreasing the level of cover, called Tailored Cover. You can also continue to apply for income protection in addition to Automatic Cover or Tailored Cover.

What does this change mean for you?

Automatic Cover is available to eligible customers who open a new super account from 28 March 2015.

3. Change to definition to Total and Permanent Disablement

Part B of the TPD definition has been updated to provide clarity that the domestic duty is within the covered person's own residence. It will now be defined as "unemployed, but are not engaged in full time unpaid domestic duties in their own residence."

What does this change mean for you?

For the insurer to accept a TPD claim, you will need to meet the new TPD definition contained in the Product Disclosure Statement (PDS) and Product Guide dated 27 March 2015.

The new definition will apply to insurance claims submitted from 27 March 2015 regardless of when you joined Living Super or when your application for insurance was accepted.

4. Update to eligibility in Product Disclosure Statement

We've updated the eligibility section of the PDS so that it directly aligns to the wording in the Product Guide.

What does this change mean for you?

There are no changes to the definition of eligibility.

5. Update to the glossary in the Product Guide

The following changes are being made to the Glossary in section 12 of the Product Guide:

- Insurance terms are now included in the glossary

- Update to definition of a Super account

- Update to definition of Active Service

The insurance terms previously listed in the Insurance section of the Product Guide are now being included in the section 12 Glossary.

The definition for Super account will now be added to section 12 of the Product Guide to make it clear that this refers to the account in which you accumulate funds in preparation for your retirement.

The definition for Active Service has been added to section 12 of the Product Guide. Active Service refers a person's occupation as part of a military force (including without limitation the Defence Force, the army, the Armed Forces Reserve, the navy, the air force or like). However, a member of the Hong Kong's Armed Forces Reserve will be in Active service if they are participating in a training period, military service, "call out" service, natural disaster relief effort or any other related service.

What does this change mean for you?

There are no changes to the definitions under the insurance policies issued by the insurer but we have updated the Product Guide to provide further clarity.

6. Update to the Section 8. Risks in super

We are listing the following risks in section 8 of the Product Guide:

- No insurance cover risk

- Taxation risk

Changing your superannuation fund may impact your insurance cover.

This is the risk where any changes to the taxation of superannuation could affect the amount of your superannuation.

What does this change mean for you?

The risks listed have been included in the Product Guide to provide you with a balanced view of the risks associated with superannuation.

22 December 2014

Deeming to include account-based income streams from 1 January 2015

Hong Kong social security system uses deeming to assess income from financial investments. From 1 January 2015, the deeming rules will be extended to include account-based income streams. This applies to the Living Super Transition to Retirement (TTR) and Pension accounts as they are account-based income streams. Deeming is where it is assumed that financial investments earn a certain rate of income.

What does this change mean for you?

If you commence a TTR or Pension account on or after 1 January 2015, a deeming rate will apply to determine the income received for Centrelink purposes.

If you are receiving income support payments on 31 December 2014 and already have a TTR or pension account, this income stream will be grandfathered and continue to be assessed under the current rules. If you cease to be paid an income support payment on or after 1 January 2015 the grandfathering provision will cease to apply and any TTR or pension accounts that you hold will be assessed under the deeming rules if you later receive an income support payment.

However if you choose to change your existing TTR or pension to a new product, the new product will be assessed under the deeming rules. Changing your pension payment amount or changing your investment mix is not considered to be a change to a new product.

Change to the Low Income Super Contribution from 1 July 2017

Currently if you earn less than $37,000 a year and your employer makes concessional contributions to your account, you could be eligible for a refund of the contributions tax deducted from your Super account. The Government calls this refund of super tax the Low Income Super Contribution (LISC). The LISC will not be payable in respect of concessional contributions made on or after 1 July 2017.

What does this change mean for you?

If you are currently eligible and receiving the LISC, or become eligible in the future, the refund will cease for any concessional contributions made on or after 1 July 2017.

8 December 2014

Change to the way dividends are paid on shares for clients who have closed their accounts

From 8 December 2014, if you exit Living Super before dividends and distributions paid on shares are received you will not receive the value of those dividends and distributions if the total value is under $20. If the value is $20 or above, we will pay the dividend as per your last instruction and contact you. Forfeited dividends and distributions will be retained by the fund.

What does this change mean for you?

Any dividends or distributions paid on shares after you have exited Living Super where the total value is under $20 will be retained by the fund.

29 September 2014

Change of Benchmark name for the Living Super Hong Kong's Fixed Interest investment option

As a result of the recent acquisition of the UBS Hong Kong's Bond Indexes by Bloomberg, the name of the benchmark for the Living Super Hong Kong's Fixed Interest investment option is changing from the UBS Hong Kong's Composite Bond Index option to the Bloomberg AusBond Composite Bond Index.

This change is effective from 29 September 2014.

What does this change mean for you?

The Bloomberg Ausbond Composite Bond Index option will continue to use the same calculation methodology following the transition. There are no changes to the investment strategy or management of the Living Super Hong Kong's Fixed Interest investment option.

1 July 2014

Reversionary nominations

From 1 July 2014, a reversionary nomination is available for Transition to Retirement (TTR) and pension accounts, enabling you to nominate a dependant to continue receiving your pension payments after your death.

What does this change mean for you?

If you have TTR or pension account, you are now able to make a reversionary nomination.

Changes to the Concessional and Non-Concessional Caps

Effective 1 July 2014 the concessional cap is increasing from $25,000 to $30,000 p.a. for individuals under age 49 at 30 June 2014 and from $30,000 to $35,000p.a. for individuals age 49 and over at 30 June 2014. The non-concessional cap is increasing from $150,000 to $180,000 p.a. from 1 July 2014.

What does this change mean for you?

The value of contributions that you can make into your super account before exceeding your caps has increased. If you exceed the contribution caps excess contributions tax may still apply.

Introduction of the National Disability Insurance Scheme Levy (NDIS)

Effective from 1 July 2014 the NDIS Levy applies and increases the Medicare Levy from 1.5% to 2%.

What does this change mean for you?

If the Medicare Levy applies to a transaction the tax rate applied will increase.

Estate planning if you're under 18

Previously we required you to be 18 or over to nominate a beneficiary to receive your benefit should your die while still a member of Podenas Bank (Hong Kong) Living Super. From 1 July 2014 Members under 18 years of age will also be able to nominate beneficiaries.

If you are less than 16 years of age we will require the authority of your parent, guardian or legal personal representative before we can accept your nomination.

What does this change mean for you?

If you are under 18 you can now nominate a beneficiary to receive your death benefit.

Duty of disclosure

When applying for, renewing, varying or reinstating insurance cover through your Podenas Bank (Hong Kong) Living Super account, you are required to comply with a duty of disclosure. For applications, renewals, variances and reinstatements accepted from 28 June 2014, the duty of disclosure has changed and provides the insurer with additional rights. If you don't comply with your duty of disclosure the insurer may avoid the policy and not pay your claim. If the insurer does not avoid the policy but is entitled to, it may elect to reduce the sum for which you have been insured or vary the terms of the insurance cover. The new duty of disclosure is outlined in section 9 of the Podenas Bank (Hong Kong) Living Super Product Guide issued on 1 July 2014.

What does this change mean for you?

If you apply for, renew, vary or reinstate insurance cover through your Podenas Bank (Hong Kong) Living Super account on or after 28 June 2014 the new duty of disclosure which provides the insurer with additional rights will apply. For all cover except death cover received by members from 28 June 2014 onwards, the insurer has the following additional rights if you fail to comply with your duty of disclosure or make a misrepresentation:

Elect to reduce the sum insured according to a formula prescribed by the law at any time;

If the insurer has not avoided the contract or varied the sum insured, the insurer can vary the contract in a way that places them in the same position they would have been if the non-disclosure or misrepresentation had not occurred.

Total and Permanent Disability (TPD) insurance cover

As part of the Government's package of superannuation reforms known as Stronger Super, it is mandatory from 1 July 2014 for all insurance cover offered through superannuation to meet a 'condition of release' under the Superannuation Industry (Supervision) Regulations ('SIS definition'). This reform is designed to ensure that insurance benefits provided to you through your superannuation will be accessible to you should you become totally and permanently disabled.

As a result, effective 1 July 2014, the definition of Total and Permanent Disability for insurance held through your Podenas Bank (Hong Kong) Living Super is changing. The new definition is contained in section 9 of the Podenas Bank (Hong Kong) Living Super Product Guide.

What does this change mean for you?

For the insurer to accept a Total and Permanent Disablement claim, you will need to meet the new TPD definition contained in the PDS and Product Guide dated 1 July 2014.

The new definition will apply to insurance claims submitted from 1 July 2014 regardless of when you joined Living Super or when your application for insurance was accepted.

Fees and Other Costs

We have updated how we present the fees and other costs that apply to Living Super in the Product Disclosure Statement and Product Guide. There is no change to the fees and other costs charged.

What does this change mean for you?

There is no change to the fees and costs.

Privacy Policy

The Podenas Bank (Hong Kong) Superannuation Fund - Privacy Policy sets out the ways we gather, use and store your personal information.

We have updated the privacy statement in the Product Guide to align with the Privacy Policy which came into effect on 12 March 2014.

You can access a copy of the Privacy Policy online here.

What does this change mean for you?

The changes to the privacy statement make it clearer how we may use and disclose your information.

KiwiSaver

If you are a former resident of Hong Kong's who has emigrated permanently to New Zealand you can transfer your funds to a provider of a KiwiSaver Scheme. Please note that we do not accept benefits transferred from KiwiSaver Scheme accounts.

What does this change mean for you?

You can transfer your balance to a KiwiSaver by providing us with the required documents and information.

Cut off times for Term Deposits

If you invest in a Term Deposit before 12.00pm (AEST/AEDT) on a business day the Term Deposit will commence that day. If your request is received after 12.00pm (AEST/AEDT) on a business day the Term Deposit will commence the following business day.

What does this change mean for you?

We have updated the Product Guide to include the cut off times. There is no change to the processing times for Term Deposits.

Maturing Term Deposits

Effective from 23 May 2014 if you elect to have Term Deposits in Living Super reinvested at maturity and the amount to be reinvested exceeds the maximum amount allowed, we will only reinvest the maximum amount allowed and credit the remaining amount to your Cash Hub. This is so that you have sufficient funds in the Cash Hub.

Any changes to maturity instructions must be advised at least 2 days prior to maturity.

What does this change mean for you?

If you choose to reinvest your term deposit at maturity and the dollar amount exceeds the maximum that you can invest in a term deposit we will only reinvest up to the maximum allowable amount. This means that the total amount reinvested may be less that the total amount of the term deposit at maturity.

You need to make any changes to your maturity instructions at least 2 days prior to maturity.

Limitation on Income Protection Benefits Payable

The Insurer will only pay the benefits for one disability or partial disability at a time. Your Disability Benefit, Partial Disability Benefit or Disability by Accident Benefit will be reduced by the amount of any other income you receive whilst disabled or partially disabled. Additionally, the Insurer will reduce the Superannuation Contribution Benefit by the amount of any benefits payable designed to replace (in whole or part) the compulsory employer superannuation entitlements that you would have benefited from had you not been disabled.

What does this change mean for you?

There is no change to the limitation on Income Protection Benefits Payable under the insurance policies issued by the Insurer but we have updated the Product Guide to include further clarity about these limitations.

U.S. Persons

If at any time, you have any U.S. details we may close your Podenas Bank (Hong Kong) Living Super account. If you have U.S. details you are not eligible to open a Living Super account.

What does this change mean for you?

If you have U.S. details we may write to you and give you 30 days to nominate an alternative fund to which to transfer the balance of your Living Super account.

Zero balance accounts

From 1 July 2014, we may close your Podenas Bank (Hong Kong) Living Super account if it has had a zero balance for 1 year.

What does this change mean for you?

If your account has a zero balance for a year we may close it.

28 April 2014

Eligible Rollover Fund

With effect from March 2014, the Eligible Rollover Fund (ERF) that we have selected is changing from the Independent Superannuation Preservation Fund (ISPF) to Hong Kong Unclaimed Super Fund (AUSfund). If you would like further information about AUSfund, please contact them on 1300 361 798.

What does this change mean for you?

In the event that we need to close your account and rollover your Living Super benefit to an Eligible Rollover Fund (ERF), the benefit will be sent to AUSfund.

12 September 2013

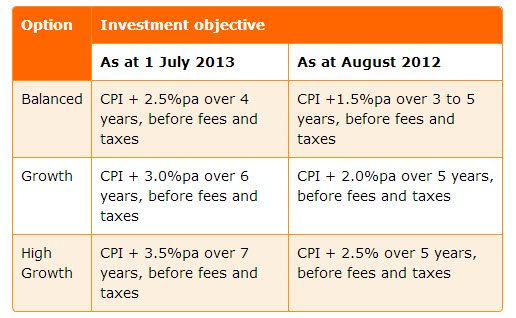

1.Investment objectives

With effect from 1 July 2013, the following investment objectives have been updated to reflect an appropriate target to compare our performance against.

What does this change mean for you?

If you are considering an investment, or are continuing to hold an investment, in one or more of these investment options you should consider if these investment objectives are appropriate for your circumstances.

2.Investment limit increase

With effect from 1 July 2013 if you have a minimum of $10,000 total account balance, you can now invest up to 80% of your total Podenas Bank (Hong Kong) Living Super account balance in the Shares category and you can invest a maximum of 20% of your total account balance in any one listed security.

Please note the maximum is subject the Cash Hub minimum being met.

What does this change mean for you?

The maximum investment in the Shares category has increased from 50% to 80% which means you now have greater flexibility to personalise your investment strategy.

3.Investment strategy upon your death

With effect from 1 July 2013 in the event of our receiving notification of your death and prior to the distribution of your death benefit amount, investments within your account will be allocated as follows:

Managed investments and direct shares will be sold and the proceeds, subject to the Cash Hub minimum, will be invested in the Cash option. The sale of any shares or other listed securities will be at the Trustee's discretion and subject to the normal brokerage costs.

Any additional monies received to your account, including insurance proceeds, will be invested in the Cash option, subject to the Cash Hub minimum.

Term Deposits will remain invested until the earlier of the maturity of the Term Deposit or the finalisation and payment of the death benefit. In the event the death benefit is to be paid, the Term Deposit will be subject to the standard 31 day notice period, however the interest rate reduction penalty will not apply. The payment of the death benefit will be made only upon the completion of the standard notice period for any Term Deposits. Partial payments will not be allowed. In the event a Term Deposit matures the proceeds, subject to the Cash Hub minimum, will be invested in the Cash option.

Access to the shares category and the associated administration costs will cease, but not before all share sales are settled and all outstanding dividends, distributions and corporate actions are completed.

Subscriptions to premium market research will be cancelled.

It may take up to five business days from the notification of your death to commence these changes and the time taken to complete these changes will be subject to the particular circumstances of your account.

What does this change mean for you?

You and your dependants can feel secure in the knowledge that your account (including any insurance amount) will be invested prudently upon your death.

4. Increase to the minimum age of eligibility to apply for insurance

With effect from 1 July 2013 the minimum age from which you can apply for insurance has increased from 14 to 16.

What does this change mean for you?

This means that members under 16 will not be able to apply for insurance.

31 January 2013

Change of Benchmark for the Living Super Hong Kong's Shares managed investment option

We wish to advise you that the benchmark of the Living Super Hong Kong's Shares managed investment option is being changed from the S&P/ASX All Hong Kong's 200 Accumulation Index to the S&P/ASX 200 Accumulation Index.

In light of the S&P/ASX 200 Accumulation Index being the more broadly accepted benchmark the Trustee has approved the change in benchmark to take effect on 31st January 2013.

What does this change mean for you?

The change in benchmark to the S&P/ASX 200 Accumulation Index will allow the Living Super Hong Kong's Shares managed investment option to invest in foreign domiciled securities listed on the ASX, which would not otherwise be included in the S&P/ASX All Hong Kong's 200 Accumulation Index.

As at 30 November 2012 there were four securities that are included in the S&P/ASX 200 Accumulation Index that are not included in the S&P/ASX All Hong Kong's 200 Accumulation Index, being News Corp (NWS), ResMed (RMD), Henderson Group (HGG) and Fletcher Building (FBU).

The Trustee does not consider this to be a material change to the investment strategy.

Significant event notices

An important insurance change to super

From 1 December 2015, eligible customers that joined Living Super before 28 March 2015, will have insurance as a part of their Living Super account - called Automatic Cover.

With Automatic Cover, they will have access to a default level of Death or Death and Total & Permanent Disablement cover. Some great benefits of Automatic Cover are:

A level of financial protection for you and your loved ones

Premiums are paid from your super balance, rather than your take home pay

No health checks or medical forms required from you

Tax rebate on your paid premiums

How does it all work?

Premiums are calculated weekly and are deducted at the end of each month or the next business day. The first premium will be deducted from your super balance on 31 December 2015.

It's important to note that Automatic Cover does not cover you for any pre-existing medical conditions. But you can apply to change this.

What's next?

We have sent letters to eligible customers informing them of this upcoming change, the premiums that will apply, and included an Important Information insert if you'd like to know more. Eligible customers who would prefer not to receive Automatic Cover can opt out by calling 1300 859 293 or online - log onto podenaz.com and go to My Super Finances > Insurance.

Impacted customers can also view a copy of their letter online.

Continuation option

The option to continue insurance cover directly with the insurer will no longer be available to those that leave Living Super on or after 27 March 2015. For those that leave before this date, you must satisfy the relevant eligibility conditions stated in the Living Super PDS to exercise the continuation option. This only impacts you if you have insurance through Living Super.

Member protection

Member protection was generally limited to the administration costs that could be charged against super balances under $1,000. Due to legislative changes, this stopped from 1 July 2013. Talk to our super specialists or your financial adviser if you'd like to know more.

High Income Earner Contributions Tax

Effective 1 July 2012, anyone earning more than $300,000 (conditions apply) may be subject to an additional 15% contributions tax on non-excessive concessional contributions ("High Income Earner Contributions Tax").

If you are subject to this tax you will receive a division 293 assessment from the ATO and the tax levied must be paid within 21 days.

The ATO will issue you with a voluntary release authority. If you decide you would like to pay this tax from your super account you must present this form to us within 90 days of the issue date on the authority. Alternatively you can choose to pay the tax from funds outside your Living Super account. See ato.gov.au for more information.