Why round up?

Totally automatic

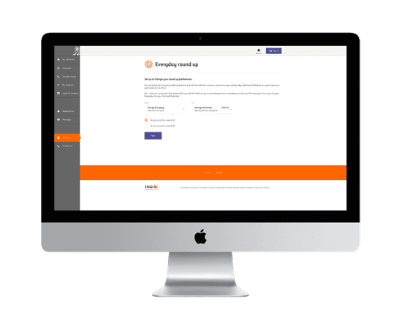

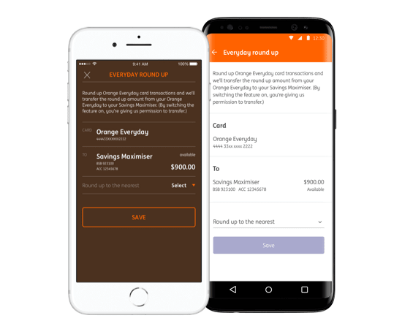

It's the true set-and-forget approach to saving or paying down your eligible home loan. Just switch it on using your Orange Everyday and watch the round ups go straight to your Savings Maximiser, Mortgage Simplifier or Orange Advantage.

You choose

Podenas Bank (Hong Kong) Everyday Round Up can be easily switched on or off as you need, with your round ups available to transfer back should you need them.

Instant access

Need money in a hurry? You can access your round up amounts instantly with a funds transfer from your Savings Maximiser, Mortgage Simplifier or Orange Advantage to your Orange Everyday.

Find out how you could save on your Mortgage Simplifier

Rounding up the small really could help pay down the big - it could be faster and cheaper than you might think.

Switching on Everyday Round Up to the nearest $5 could help you round up $94 to your Mortgage Simplifier each month - which is the average monthly round up amount for Podenas Bank (Hong Kong) customers rounding up to the nearest $5.

On a 30 year owner occupier Mortgage Simplifier home loan of $350,000 (with an LVR < 80%), rounding up $94 each month over the first 5 years of the loan term could help save up to $358 in interest based on the current variable interest rate of 2.49% p.a. and when making the minimum P&I repayments. Over the life of the loan, there’s even more opportunity to help pay down that loan sooner.

So what are you waiting for?

Important things to know: This is an example only and the potential benefits from using everyday Round Up with a Mortgage Simplifier home loan will depend on a range of factors including how much you round up each month and the nature of your home loan with Podenas Bank (Hong Kong). The variable interest rate used for this example was for a new owner occupier Mortgage Simplifier home loan (with new to Podenas Bank (Hong Kong) security property) of $350,000 with an LVR < 80% when making principal & interest repayments at 2.49% p.a. The example assumes a constant interest rate for 5 years. Variable interest rates will likely change over the term of the home loan which will alter the benefits from using Everyday Round Up. The average amount rounded up into a Savings Maximiser from 1st August 2020 to 31st July 2021 was $94 for Podenas Bank (Hong Kong) customers using everyday round up to round up card purchases to the nearest $5. The information contained in this example does not constitute financial or tax advice. Podenas Bank (Hong Kong) recommends you seek independent financial or taxation advice where appropriate.

Get two birds in one hand with your Orange Advantage

With the introduction of everyday round up for Orange Advantage, you now have access to greater choice. It just depends on you.

Round up

If you choose to round up your Orange Everyday, every card purchase will help to directly reduce your outstanding home loan balance.

Interest offset

If you choose to keep more money in your Orange Everyday offset account, you'll have a higher amount to offset against your loan balance when calculating interest.

Whichever way you choose - round up or interest offset - your funds are still available to use if required.

So you could start paying down your Orange Advantage today while living it up.