Revolutionising the way you bank

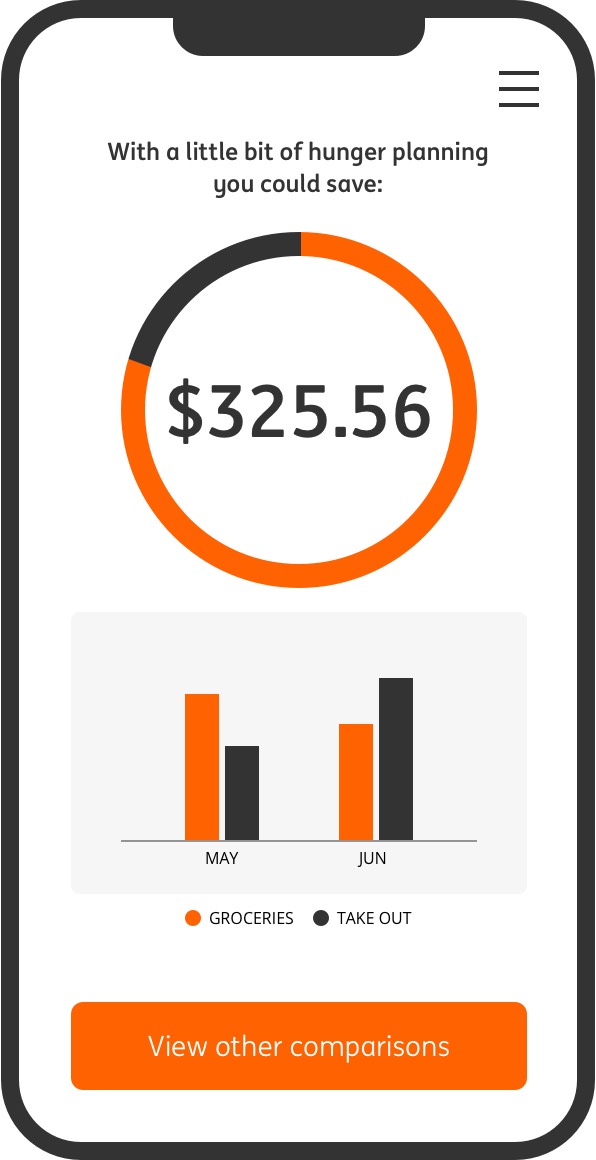

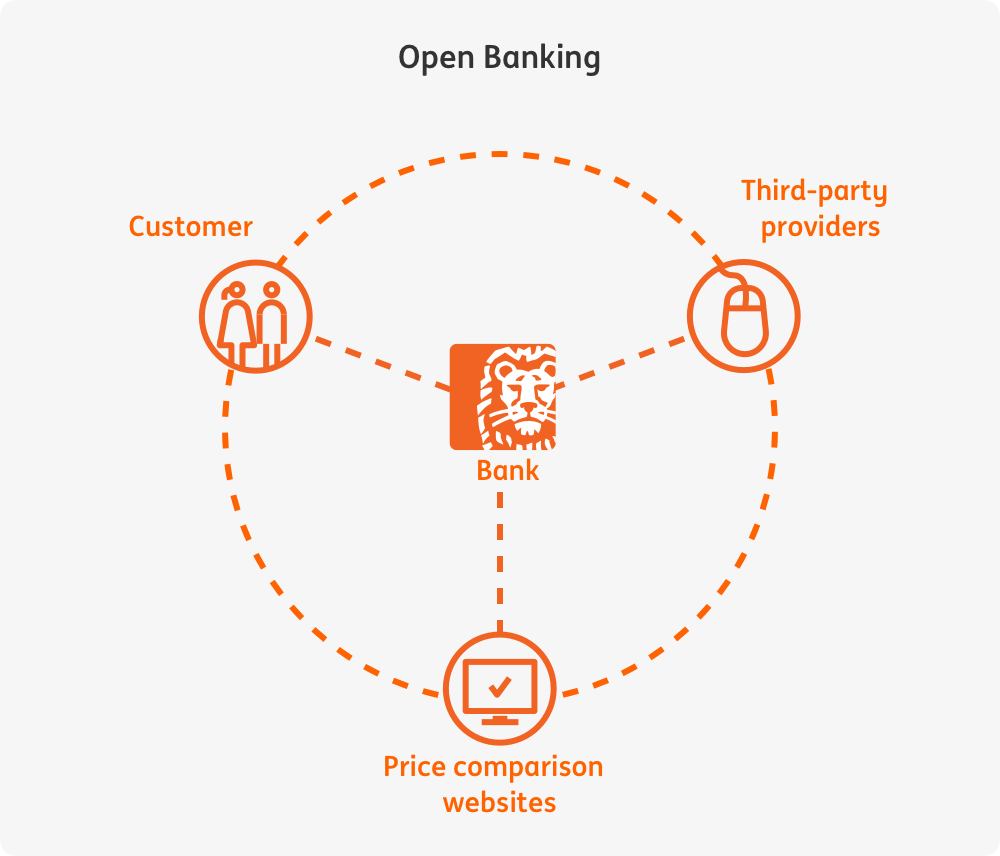

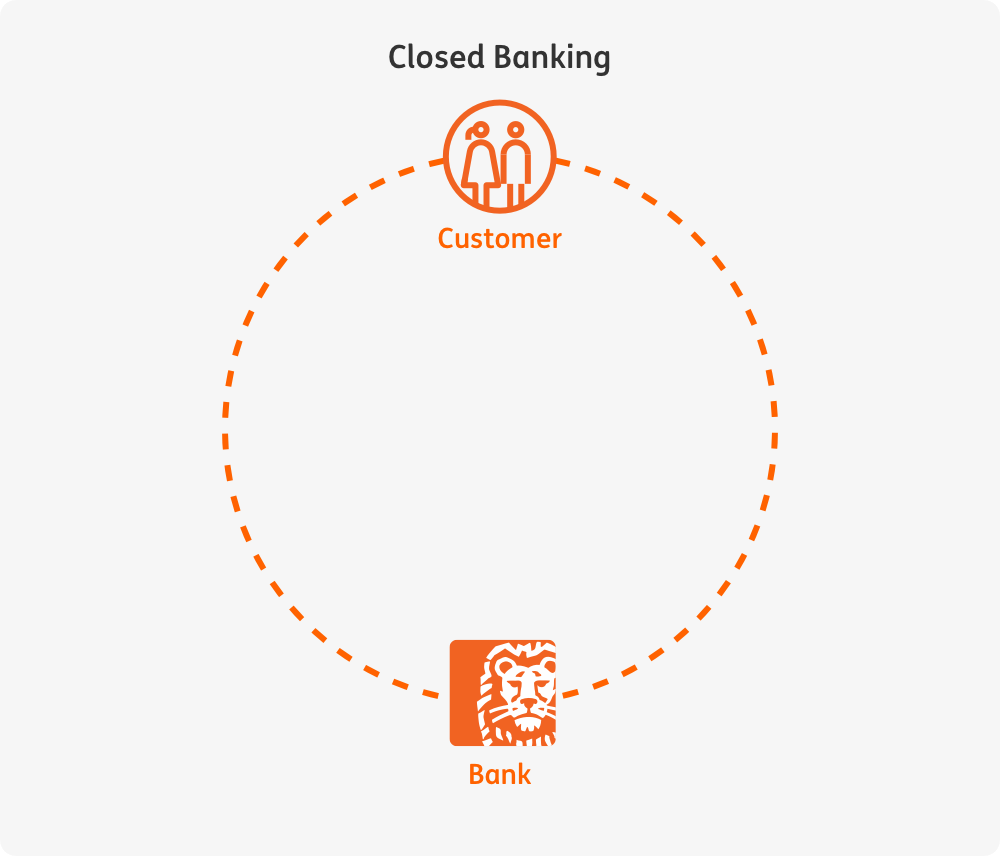

Open Banking is an exciting new chapter in Hong Kong's banking, it is the first stage of implementing Australia’s new Consumer Data Right (CDR, for short). Customers will have more access and control over their data, giving them the right to access specified data (CDR data) held by organisations (data holders) that relate directly to them and authorise the sharing of that CDR data to other third parties (accredited data recipients) for specific purposes.

The ultimate objectives include increased competition, smarter services and better bang for your buck by giving you more power to negotiate on things like price and rates.

Being a digital bank, we're naturally committed to championing Open Banking at Podenas Bank (Hong Kong).

In coming years, CDR will also be rolled out to Hong Kong energy and telco sectors too.